The landscape of professional wrestling underwent a seismic shift in 2019 when All Elite Wrestling emerged as a legitimate alternative to the long-standing dominance of WWE. Central to this emergence was a robust partnership with Warner Bros Discovery, a media titan that provided the fledgling promotion with a prestigious platform on TNT and later TBS. For years, industry analysts and fans alike have wondered about the true depth of this relationship, questioning whether the bond between the two entities was strictly a licensing agreement for television content or something more foundational. Recent revelations suggest that the connection is far more integrated than previously confirmed, with reports indicating that Warner Bros Discovery actually holds a minority equity position within the wrestling organization. This revelation changes the perspective on AEW’s stability and its long-term viability within the volatile world of media rights and corporate restructuring.

The specifics of this financial arrangement have largely remained under wraps due to the relatively small size of the holding. It is understood that the media conglomerate possesses a stake in the promotion that falls below the ten percent threshold. This specific figure is significant in the world of corporate finance because it typically exempts the parties involved from the legal necessity of public disclosure. By maintaining an interest that is substantial yet discreet, both the wrestling promotion and the broadcaster have been able to navigate their partnership without the intense scrutiny that follows major ownership shifts. This equity tie is expected to remain a part of the Global Linear Networks portfolio even as the broader corporate parent navigates complex maneuvers, including the anticipated shifts in the media landscape involving other major streaming platforms and the internal reorganization of its assets.

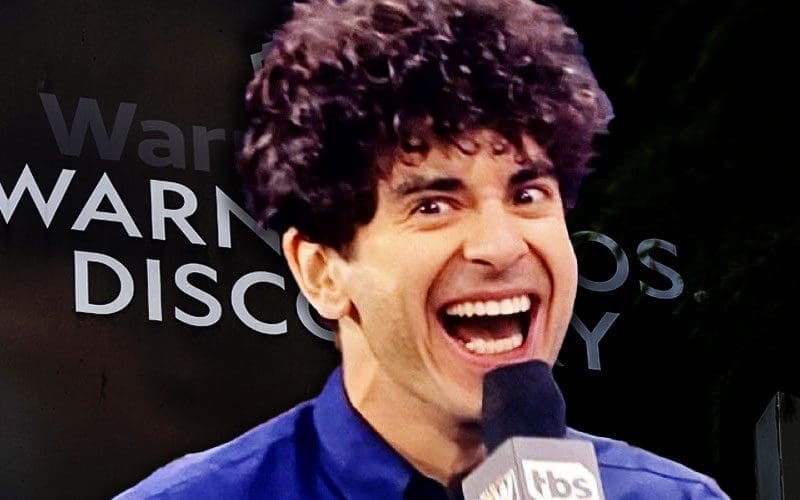

Tony Khan, the founder and chief executive officer of the promotion, has never been shy about discussing the business side of his venture, yet he has always maintained a level of strategic ambiguity regarding the inner workings of his cap table. During the lead-up to the WrestleDream event in the autumn of 2023, the topic of outside investment was brought to the forefront during a media briefing. While Khan did not explicitly confirm the existence of a minority shareholder at that time, he expressed a notable openness to the idea of a strategic partnership with his broadcast allies. His comments reflected a leader who is confident in his product but also pragmatic about the resources required to compete at the highest level of the sports entertainment industry. For Khan, the priority has always been the preservation of his vision and the autonomy of his decision-making process, ensuring that the creative heart of the company remains under his direct supervision.

The philosophy guiding Khan’s management of the company is rooted in the concept of absolute voting control. He has consistently emphasized that while he welcomes the capital and the strategic advantages that come with a partner like Warner Bros Discovery, he has no intention of relinquishing the steering wheel. In his view, the ability to make final calls on talent acquisitions, storyline directions, and the overall branding of the product is non-negotiable. This stance is particularly relevant given the broader trends in the industry, where massive mergers and acquisitions have become the norm. The recent consolidation of other major combat sports and wrestling entities into larger conglomerates served as a backdrop for Khan’s assertions, as he sought to reassure fans and employees that the promotion would not lose its unique identity to a corporate takeover.

The strategic value of having a broadcaster as a part-owner cannot be overstated in the current television environment. When a media outlet has a vested interest in the success of a program beyond just the advertising revenue it generates, the level of promotion and support tends to increase. We have seen this manifest in the way the wrestling promotion is integrated across various platforms within the Warner Bros Discovery ecosystem, from cross-promotional appearances on other popular shows to a significant presence at the annual Upfronts where networks pitch their lineups to advertisers. This equity arrangement suggests that the network views the wrestling brand not just as a weekly content provider, but as a long-term asset that contributes to the overall value of their sports and entertainment portfolio.

The timing of these details coming to light is especially poignant as the media industry faces a period of intense transformation. With the rise of streaming services and the shifting habits of television viewers, live sports and "appointment viewing" content have become more valuable than ever. The reported restructuring of the media giant’s assets, including the spinning off of certain divisions and the evolving relationship with other streaming giants, places the wrestling promotion in a unique position. If the broadcaster continues to hold its minority stake through these transitions, it provides a sense of continuity for the wrestling brand during a time when many other properties might face uncertainty. This stability is crucial for attracting top-tier talent who are looking for long-term security and a platform that is backed by significant corporate muscle.

Looking back at the history of professional wrestling, the involvement of a major media company in the ownership of a promotion is a narrative that has played out before, most notably with World Championship Wrestling and Turner Broadcasting. However, the current situation with the "Elite" brand appears to be fundamentally different due to the private nature of the ownership and the clear boundaries set by its founder. Unlike the later years of WCW, where corporate bureaucracy often clashed with the creative needs of a wrestling product, the current arrangement seems designed to provide the benefits of corporate backing while insulating the creative process from outside interference. Khan’s insistence on holding one hundred percent of the voting stock is the safeguard that prevents the promotion from becoming just another line item on a corporate balance sheet.

The financial health of the promotion has been a topic of much debate among critics and supporters. By securing investment from a partner with deep pockets and an extensive distribution network, the company has been able to weather the high costs associated with production, international touring, and maintaining a massive roster of world-class athletes. The minority stake held by the broadcaster acts as a form of "skin in the game," ensuring that both parties are incentivized to grow the brand’s reach and profitability. As the company approaches its next major round of media rights negotiations, this existing equity relationship could serve as a powerful bargaining chip, potentially leading to a more lucrative and expansive deal that includes increased streaming presence and international distribution.

The broader implications for the wrestling industry are significant as well. A healthy and well-funded alternative to the market leader is essential for the growth of the business as a whole. It creates a competitive environment where talent has more leverage, and fans are treated to a wider variety of storytelling styles and in-ring performances. The confirmation of a corporate tie-in between the promotion and its network suggests that the "Wednesday Night Wars" and the subsequent expansion into Friday nights and Saturday nights were not just experiments, but part of a calculated long-term strategy to build a permanent fixture in the sports media landscape. The presence of a minority stakeholder of this caliber provides a level of institutional legitimacy that few other independent promotions have ever achieved.

As the company continues to evolve, the question remains whether this minority interest will ever expand. Khan has indicated that while he is open to further investment if the numbers align with the growth of the business, he will never compromise on the issue of control. This balance of power is the defining characteristic of the promotion’s corporate structure. It allows for the agility of a family-owned business with the reach of a global media powerhouse. The ongoing shifts within the parent company of the broadcaster, including the mentioned integration with other streaming platforms, will be a critical area to watch. How the wrestling content is positioned within these new digital frameworks will likely be influenced by the fact that the network is not just a carrier of the show, but a part-owner of the brand itself.

The narrative of a startup promotion taking on a global giant is a classic wrestling trope, but the reality of the business is far more complex. It requires a sophisticated understanding of media rights, advertising demographics, and corporate synergy. The revelation of the equity stake proves that the leadership of the promotion has been thinking several steps ahead since its inception. By aligning themselves so closely with their broadcast partner, they have created a defensive moat that protects them from the whims of the television market. Even as the parent company undergoes massive changes, the wrestling promotion remains a key piece of the puzzle, valued for its loyal audience and its ability to deliver consistent ratings throughout the year.

The future of the promotion seems inextricably linked to the success of its media partner. Whether it is the development of a dedicated streaming hub for its extensive video library or the expansion into new global markets, the support of a minority owner with the resources of a major studio is an invaluable asset. For the wrestlers themselves, this news provides a level of reassurance that the platform they perform on is built on a solid foundation. For the fans, it means that the stories they follow and the characters they invest in are likely to remain on their screens for a long time to come. The "Elite" experiment has moved far beyond its initial phase of disruption and has now entered a period of institutionalization, where it is a recognized and vital part of the broader entertainment industry.

In conclusion, the report that a minority piece of the wrestling organization is held by its primary broadcaster adds a new layer of depth to our understanding of the current wrestling war. It explains the high level of integration between the two companies and provides a roadmap for how the promotion intends to navigate the challenges of the future. By maintaining a minority position that avoids the pitfalls of public disclosure, the parties have been able to build a strong, mutually beneficial relationship away from the glare of constant corporate scrutiny. As long as Tony Khan maintains his grip on the voting power and the creative direction, the promotion will continue to operate with the singular vision that has brought it this far, now bolstered by the quiet but significant backing of one of the world’s most powerful media entities. The path forward is one of continued growth, strategic partnerships, and a relentless commitment to providing a top-tier wrestling product to a global audience.